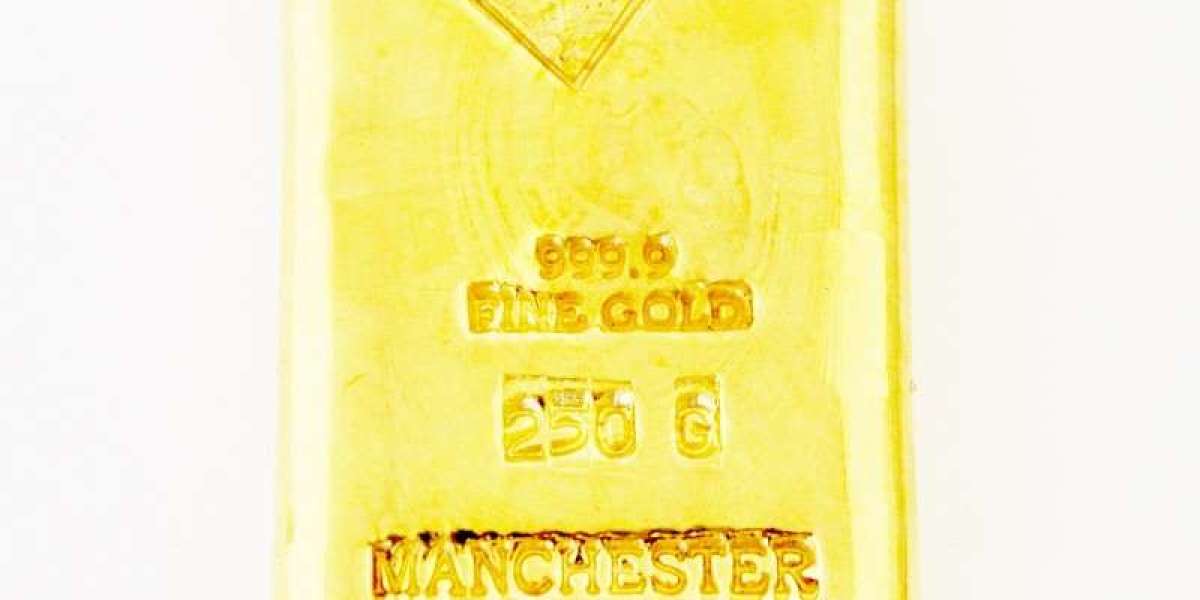

Bullion bars, also known simply as gold bars, are one of the most popular forms of gold investment. These bars are prized for their purity, weight, and the security they offer as a tangible asset. Whether you're a seasoned investor or new to the world of precious metals, bullion bars can be a smart addition to your investment portfolio. This guide explores the benefits of investing in bullion bars, how to purchase them, and the best practices for storage.

What Are Bullion Bars?

Bullion bars are refined gold bars that come in various sizes and weights, typically measured in grams or ounces. They are produced by mints and refineries around the world and are valued primarily for their gold content. The most common weights for gold bars include 1 gram, 10 grams, 100 grams, and 1 kilogram.

Benefits of Investing in Bullion Bars

- Purity and Value: Bullion bars are usually produced with very high purity, often 99.99% gold (24 karats). This high purity ensures that the bars retain significant intrinsic value.

- Hedge Against Inflation: Gold has historically been a reliable store of value, maintaining its worth over time. Investing in bullion bars can help protect against inflation and currency devaluation.

- Liquidity: Bullion bars are widely recognized and accepted globally. They can bullion bars be easily bought, sold, or traded, providing high liquidity for investors.

- Diversification: Adding gold bullion bars to your investment portfolio can diversify your assets, reducing overall risk and providing a stable counterbalance to more volatile investments like stocks and bonds.

How to Buy Bullion Bars

- Reputable Dealers: Purchase from authorized and reputable dealers to ensure the authenticity and quality of the bullion bars. Look for dealers accredited by recognized organizations such as the London Bullion Market Association (LBMA).

- Banks and Financial Institutions: Some banks offer gold bars for sale, providing a secure and trustworthy option for buyers.

- Online Retailers: Numerous online platforms specialize in selling bullion bars. Verify the credibility of the seller by checking for certifications, customer reviews, and secure payment methods.

- Auctions and Private Sales: Occasionally, bullion bars can be found at auctions or through private sales. This route can sometimes offer competitive prices but requires thorough research and due diligence.

Factors to Consider When Buying Bullion Bars

- Purity: Ensure the bullion bar is of high purity, typically 99.99% (24 karats). Check for certification that guarantees its purity and weight.

- Weight: Bullion bars come in various weights. Choose a weight that fits your investment goals and budget. Smaller bars like 1 gram or 10 grams are more affordable, while larger bars like 100 grams or 1 kilogram offer better value per gram.

- Current Market Price: Gold prices fluctuate based on market conditions. Stay informed about current gold prices to make an informed purchase.

- Premiums: Understand the premiums over the spot price of gold. These premiums cover manufacturing, distribution, and dealer margins.

- Brand and Refinery: The reputation of the mint or refinery producing the bullion bars can affect their resale value. Bars from well-known refineries may carry a premium.

Tips for Buying Bullion Bars

- Research: Educate yourself about the gold market, price trends, and market conditions.

- Verify Sellers: Always buy from reputable dealers and verify their credentials.

- Check for Certification: Ensure the bullion bar comes with a certificate of authenticity and purity.

- Understand Costs: Be aware of all costs involved, including premiums, shipping, and storage.

Storing Your Bullion Bars

- Home Safes: Invest in a high-quality safe that is both fireproof and burglar-proof to store your bullion bars securely.

- Bank Safety Deposit Boxes: These offer a secure and insured option for storing your bullion bars.

- Specialized Storage Facilities: Some companies offer secure storage facilities specifically for precious metals, providing high levels of security and insurance.

Conclusion

Bullion bars are a solid and strategic investment for those looking to diversify their portfolios and secure their wealth. Their high purity, intrinsic value, and liquidity make them an attractive option for both new and experienced investors. By purchasing from reputable sources, staying informed about market conditions, and ensuring proper storage, you can confidently invest in bullion bars and enjoy the benefits of this timeless and stable asset.