Raydium Swap hopes to address the liquidity issue in DeFi by developing an AMM that connects to an on-chain request book on a fast Radiyum, Raydium Swap, Raydium Swap Exchange, and versatile organization.

Advantages of Raydium: In addition to a user-friendly interface, double prize cultivation, and a robust trading experience, Raydium grants players access to well-known IDOs and NFT drops.

Barriers of Raydium: The most harm is caused when Raydium is used with only one DEXSerum.

The popular term for the combination of distributed record technology and the conventional monetary system is Raydium Decentralized money (DeFi). Although DeFi is brilliant in its entirety, it still lacks widespread acceptance. The majority of conventions are sent through the Ethereum organization, which is currently slow and cannot be scaled up. This is the primary reason.

Serum decided to create a fully integrated decentralized trade by combining the Solana blockchain with the Ethereum organization block. The objective was to address the liquidity issue in DeFi and Radiyum,raydium swap,raydium swap exchange by creating a request book for an agile organization. Raydium was made as a result.

Raydium: Which is it?

On the Solana blockchain, Raydium is distributed as an on-bind liquidity provider to a focal cutoff request book. In contrast to other decentralized automated market makers (AMMs), Serum's structure book receives immediate liquidity from Raydium's AMM. Because it provides merchants with inexhaustible liquidity through a novel numerical condition, Raydium is one of the biggest Market Makers on Serum. The stage uses the Fibonacci strategy's constant limit of K = Y*X to give its customers access to 20 orders at two prices with spreads as low as 20 bps between them.

The Best Price Swaps feature on Raydium determines whether clients will receive the best price by trading within a liquidity pool or through the Serum request book. Raydium utilizes the Solana organization and the focal request book of the Serum DEX to work with lightning-quick exchanges in addition to providing liquidity for Serum and incorporating a few yield-cultivating features.

The majority of AMMs access liquidity through their conventions rather than a request book. Advantages of Raydium A Powerful Trading Experience Raydium grants liquidity providers access to the liquidity and request stream of the entire serum environment because it provides on-tie liquidity to the focal cutoff request book of the Serum DEX. Additionally, the stage makes use of the efficiency of the Solana blockchain to facilitate quick transactions at exceptionally low costs.

Instinctive Interface Attracting dealers and customers requires a user-friendly UI. Raydium's user interface makes it easy for both novices and professionals to offer liquidity or exchange on the platform without having to look into complicated arrangements. In addition, clients can control their exchanges by drawing line requests and viewing TradingView diagrams on the platform.

You can get free cryptocurrencies by watching videos. Double Reward Farming When a liquidity provider (LP) provides liquidity on the platform, Raydium issues a LP token addressing the LP's pool share. In exchange for RAY tokens, the Raydium people group can select pools that can produce these tokens. By depositing RAY tokens into a pool to distribute in exchange for holding local tokens, tasks can also boost clientele.

Through high-liquidity beginning dex contributions (IDOs), Raydium's High-liquidity Launches AccleRaytor endeavors to lead the development of the Solana biological system. It serves as a launchpad for ventures further down the line to raise capital and drive introductory liquidity in a decentralized and interoperable manner, allowing the undertaking and the Raydium people group to participate in carefully organized and confirmed symbolic contributions.

The most significant drawback of Raydium is that it can only be used in conjunction with one DEX, serum. In order to offer its customers the most competitive and cost-effective trade price, Raydium ought to collaborate with other DEXs.

How do I use Raydium? The most effective method to Get 8.5% APR on a Crypto Premium Record

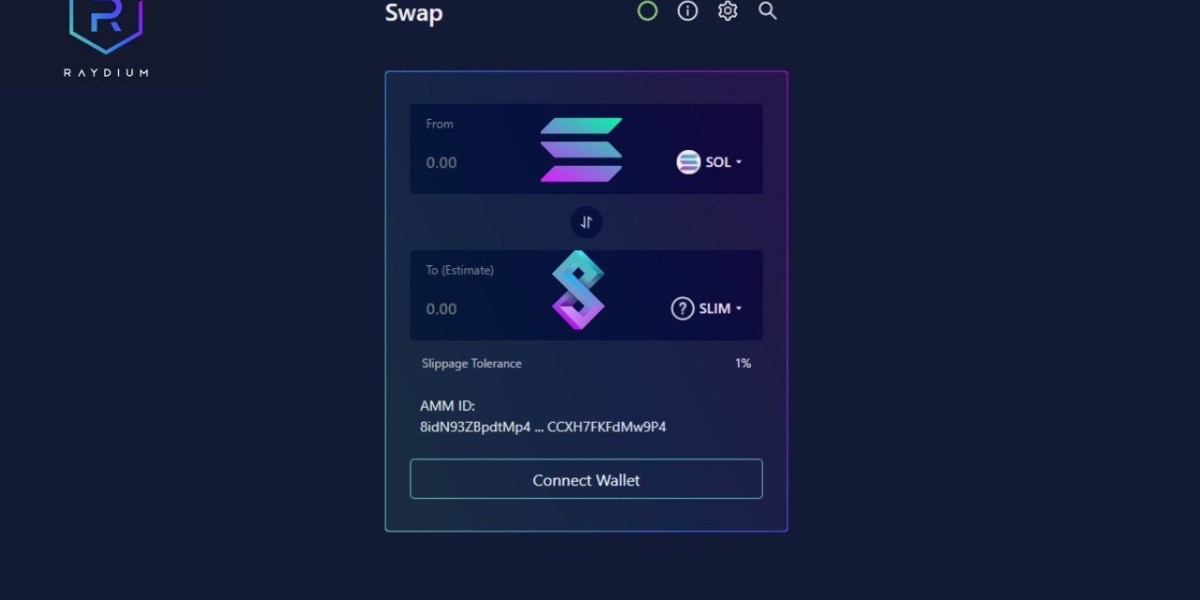

Raydium gives an assortment of section focuses for the stage. First and foremost, traders are able to quickly trade two tokens through the Serum DEX thanks to the trade feature of the Radiyum, raydium swap, and raydium swap exchanges. It also takes into account advanced exchange features like breaking point orders for a better user experience. Second, customers can wager RAY tokens on the Raydium app in exchange for additional RAY to participate in IDOs and NFT drops. By contributing resources to a specific pool, Raydium clients can ultimately provide liquidity. They will therefore receive fees for trading and double the yield on their expanding tokens.

End In order to assist other members of the DeFi and AMM communities in developing their products on Solana, Raydium plans to collaborate with them as it develops its role as a liquidity provider on Serum. This will lead to more liquidity as well as faster and more efficient DeFi conventions.

Consequently, Raydium provides a path for continued DeFi development, enabling individuals and businesses to quickly enter the Solana and Serum universe and benefit from its unmistakable speed and productivity advantages. Because, ultimately, faster exchanges, overall lower costs, and environment-wide liquidity are necessary if individuals, Radiyum, raydium swap, and raydium swap exchange ventures, as well as conventions in DeFi, are to advance, improve, and develop.