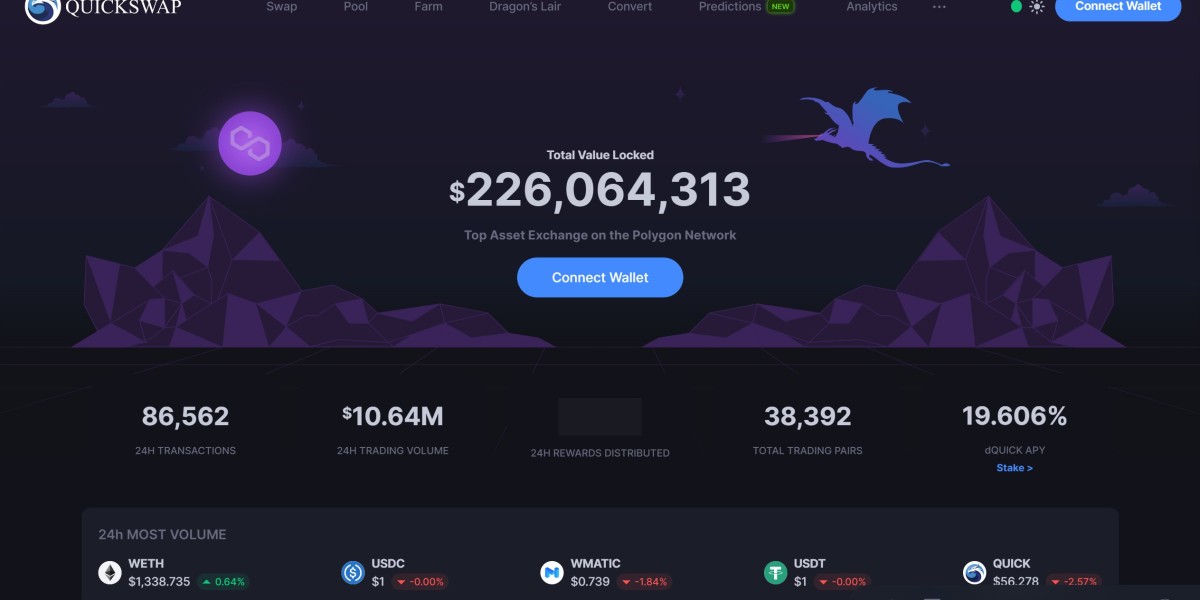

QuickSwapAudit: Polygon's Layer 2 DEX

QuickSwap is another expansion to the decentralized exchange (DEX) scene, however with a distinction that is permitting it to stand apart among its rivals. While it depends on Ethereum, it is based on the layer-2 framework of the Polygon (previously Matic Organization), which gives various advantages not seen in that frame of mind as Uniswap.

Since it involves layer-2 foundation for its exchanges the clients of QuickSwap can exchange any of the a huge number of ERC-20 resources with very nearly zero gas costs and at easing up quick paces.

QuickSwap likewise utilizes a local area based administration structure, and a fair symbolic dispersion that was not in view of any pre-mine or confidential contribution. The DEX enables its clients and merchants and eliminates the over the top costs that have become related with the DEX in 2021.

QuickSwap highlights areas of strength for an of liquidity suppliers too, which is the consequence of yield cultivating and liquidity mining open doors that have boosted the development of the stage.

Moreover, not at all like a considerable lot of the food-named exchanges QuickSwap was created, made, and supported by a portion of the Ethereum environment's ideal and most brilliant idea pioneers. They bring broad information and experience of layer-2 versatility and Ethereum agreement and token norms to the DEX.

The group at Quick Trade accepts this layer-2 convention is the up and coming age of decentralized exchanges and exchanging, and it will introduce the following influx of merchants to enter the DeFi scene.

Why We Really want a Layer-2 DEX

Decentralized finance filled so quickly in 2020 that by 2021 the DeFi environment had arrived at a basic point because of the dramatic development of yield cultivating, liquidity mining, and DeFi exchanging.

This development put tremendous weights on the Ethereum mainchain, as was plainly seen by all DeFi clients. The expanded DeFi convention utilization has caused exchange times and gas expenses to soar, seemingly forever.

The most famous decentralized exchanges like Uniswap and SushiSwap are totally reliant upon the Ethereum mainchain for their exchanges. While not exclusively answerable for the organization blockage seen on the Ethereum mainchain, they are tremendous supporters of that clog. This is really unfavorable and has made them casualties of their own prosperity.

At the point when Uniswap gave its UNI token n September 16, 2020 the exchange charges on Ethereum took off to a high of 800 GWEI ($6.31) for a quick exchange of under 30 seconds. Those able to hang tight for 11 minutes or longer could exploit the sluggish exchange expenses of $3.98.

Quick forward to May 2021 and as you can see from the picture over the circumstance is minimal gotten to the next level. As a matter of fact, gas costs proceed gradually moving higher, and DeFi defenders keep searching for options in contrast to the Ethereum organization.

Likewise note that while utilizing Uniswap or other DEX conventions the gas costs are a lot higher. They increment by a component of 10x, truth be told! That implies clients are paying as much as $40 or more in gas charges for a solitary exchange to be affirmed in less than 30 seconds.

It's conspicuous to everybody that these over the top and consistently rising gas costs and long exchange times are not helpful for carrying new brokers into the DeFi environment. What's more, without a developing and flourishing DeFi people group standard reception of DeFi will be unimaginable.

There's a tremendous division in the DeFi biological system in as much as the more individuals that come installed, the more prominent organization blockage becomes, but the more prominent organization clog turns into the harder it is to carry new clients into the DeFi environment. This conundrum is keeping DeFi from arriving at its actual potential and until it is settled it will keep on doing as such.

What DeFi needs is a versatile, elite presentation, minimal expense framework that considers the development of the environment without making colossal exchange charges, and unreasonably lengthy exchange times.

The uplifting news is we as of now have an answer in layer-2 conventions. What's more, QuickSwap is the DEX that is driving the way on the layer-2 front. QuickSwap accepts it has the answer for the issues presently influencing the ongoing harvest of DEXs.

What is QuickSwap?

QuickSwap is a recently evolved permissionless decentralized exchange that depends on Ethereum and is fueled by Polygon's layer-2 versatility framework.

Like the way other DEXs work, anybody can come to QuickSwap and exchange any ERC-20 token whatsoever. Assuming the resource is an ERC-20 symbolic that isn't as of now upheld by the exchange clients can list the token by essentially giving liquidity to empower moment trades.

The client giving liquidity in this manner then, at that point, procures the charges produced each time another client makes an exchange utilizing thatQuickswap exchangepair, which boosts clients to give liquidity however much as could reasonably be expected.

Liquidity suppliers are boosted by both liquidity mining open doors, and by yield cultivating open doors. As well as being qualified for a piece of the 0.3% exchange charge exacted by the stage on each exchange, liquidity suppliers likewise gather a portion of the local QUICK administration token for partaking in liquidity provisioning.

This gives the liquidity suppliers a stake in the stage on the grounds that the convention is represented by the local area of QUICK holders. That people group can make proposition and decision on those recommendations to adjust or add to the boundaries being utilized.

These incorporate the exchange charge, or how much expenses imparted to the liquidity suppliers. QuickSwap was worked with an emphasis on local area administration, and its engineers expect for it to be run completely by the local area.

While all of that could make QuickSwap sound like one more clone of Uniswap, the way that QuickSwap utilizes a layer-2 mix makes it universes unique in relation to Uniswap and other computerized market creator (AMM) stages.

Since QuickSwap uses a layer-2 answer for its exchanges it implies brokers can appreciate almost zero gas expenses and easing up quick exchange speeds.

As an examination, as of now a quick exchange (under 30 seconds) on the Ethereum network costs $4.23. Anyway a Uniswap trade with a quick exchange speed is $40.28. A similar exchange on QuickSwap utilizing the Polygon network costs generally $0.00001 and exchange affirmations are finished in just 1 second.

By using its layer-2 arrangement QuickSwap is eliminating the enormous exchange costs and slow exchanges of the Ethereum organization, making DeFi more available for everybody.

This is supposed to permit the following, and bigger, flood of brokers to enter the DeFi biological system. QuickSwap brings easing up quick exchanges and almost zero exchange charges to decentralized exchanging, yield cultivating, and liquidity mining.

Polygon (previously MATIC Organization)

Polygon is the stage that QuickSwap is based upon. Rebranded from MATIC Organization in the principal quarter of 2021 Polygon is a profoundly designer cordial convention in light of Ethereum.

It utilizes a cross breed Confirmation of-Stake and Plasma to establish a climate where designers can undoubtedly and quickly convey Ethereum viable dApps that can likewise scale effectively as they develop.

Using PoS designated spots Polygon can utilize the Ethereum mainnet to finish exchanges, giving dApps Ethereum's security. Simultaneously Polygon exchanges are far less expensive than the Ethereum gas charges, and are additionally far quicker, with exchanges being handled in less than 2 seconds.

QuickSwap Stage Elements

Despite the fact that QuickSwap is fabricated utilizing layer-2 foundation, offering merchants every one of the well known highlights of the main decentralized exchanges is as yet capable.

What's more it additionally gives the unaccounted for piece of those famous DEXs - to be specific quick exchanges with almost no exchange charges. The following are the elements you'll find while utilizing QuickSwap:

Permissionless Postings

Clients can list any of the a large number of ERC-20 tokens on QuickSwap, similarly as they can on any of the other driving DEX stages.

All that is expected to list a token is to give liquidity to an exchanging pair. Not at all like conventional exchanges there is compelling reason need to apply for consent from any individual or substance to list a resource.

Layer-2 Exchanges

The exchanges onQuick Swapare controlled by Polygon (previously the Matic Organization, which is a plasma-based layer-2 Ethereum based versatility arrangement. This implies the resource trades on QuickSwap are acted in less than two seconds for a little portion of the gas costs that brokers insight on the Ethereum mainchain.