Understanding the fair value of National Australia Bank Ltd (ASX: NAB) shares can be challenging, especially in today's volatile market environment. In this article, we'll delve into the critical factors to consider when researching a bank share, providing insights for investors navigating the complexities of the financial sector.

National Australia Bank

As one of largest ASX banking stock in terms of market capitalization, profits, and customer base, NAB holds a prominent position in the financial landscape. Additionally, NAB is a significant lender to businesses and maintains a strong presence in residential lending through brands like Ubank, catering to mortgages and personal loans.

Assessing Workplace Culture

For long-term investors, the workplace culture of a company can significantly impacts its financial success. By analyzing employee reviews and overall workplace culture ratings, investors gain insights into retention rates and long-term performance potential. Seek's website provides valuable data on companies' HR metrics, offering a glimpse into factors that influence NAB's operational efficiency and employee satisfaction.

Lending Standards and Profitability

The profitability of bank shares like NAB hinges on robust lending standards and healthy profit margins. Net interest margin (NIM) serves as a critical measure, reflecting the difference between interest earned on loans and interest paid to depositors. While NAB's NIM of 1.77% indicates a lower-than-average return compared to peers, further investigation is necessary to understand underlying factors contributing to this performance.

Return on Equity (ROE)

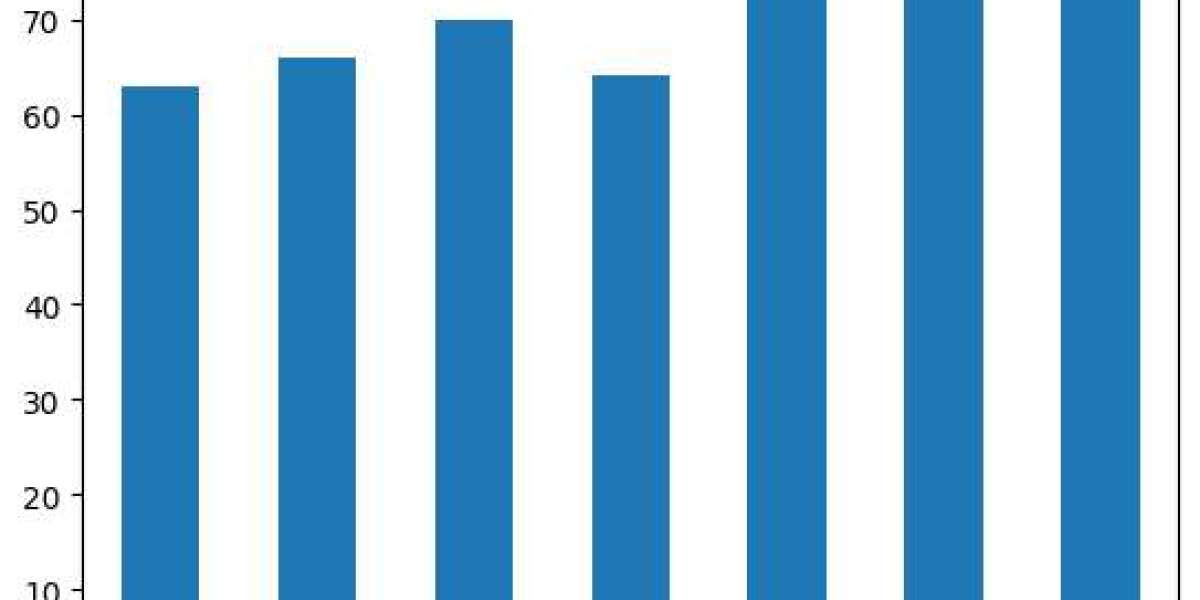

ROE offers insights into a bank's profitability relative to shareholder equity. With NAB's ROE standing at 13.7% in the latest full year, surpassing the sector average, investors gain visibility into the bank's ability to generate profit from shareholder investments. However, ongoing monitoring of ROE trends is essential to assess NAB's long-term financial health and performance sustainability.

Capital Structure and Stability

The common equity tier one (CET1) ratio serves as a critical indicator of a bank's capital buffer and financial stability. NAB's CET1 ratio of 11.4% underscores its resilience against financial risks, although it falls below the sector average. Understanding NAB's capital structure provides investors with insights into its capacity to weather economic uncertainties and regulatory challenges.

Dividends and Valuation

A dividend discount model (DDM) offers a comprehensive approach to predicting future dividends and assessing a bank's valuation. By considering forecast dividends and applying multiple risk rates, investors can derive a fair value estimate for NAB shares. While the simple DDM model suggests a valuation of $28.38, incorporating adjusted dividend payments and franking credits yields a valuation prediction of $41.52.

Conclusion

In conclusion, understanding the intricacies of National Australia Bank Ltd (ASX: NAB) shares requires a comprehensive analysis of various factors, including workplace culture, lending standards, profitability metrics, capital structure, dividends, and valuation. As investors evaluate the NAB share price and weigh potential risks and opportunities, it's essential to conduct thorough research and consider all available data to make informed investment decisions.