AI in Fintech 2024

The integration of Artificial Intelligence (AI) in the financial technology (Fintech) sector has introduced a new era of innovation, optimizing financial services and offering advanced solutions for consumers and businesses alike. AI in Fintech Market Trends indicate that AI's ability to automate tasks, predict financial trends, enhance security, and personalize customer experiences is reshaping how financial institutions operate. From improving risk management to offering personalized investment advice, AI is fundamentally altering the landscape of the financial industry.

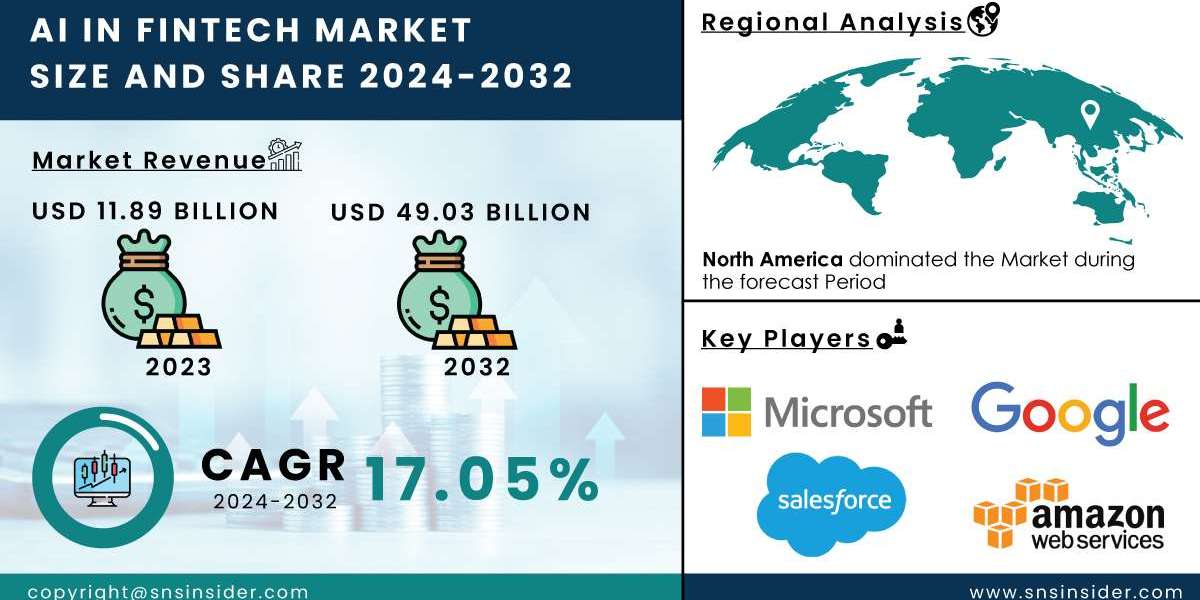

AI in Fintech Market was valued at USD 11.89 billion in 2023 and is expected to reach USD 49.03 billion by 2032 and grow at a CAGR of 17.05% over the forecast period 2024-2032.

Enhancing Risk Management and Fraud Detection

One of the primary applications of AI in Fintech is its role in improving risk management and fraud detection. Traditional methods of assessing financial risk often rely on historical data and predefined models. However, AI can analyze vast amounts of data from multiple sources in real time, identifying patterns and anomalies that might indicate potential fraud or risky behavior. Machine learning algorithms can continuously learn and improve, enabling more accurate assessments of creditworthiness, transaction legitimacy, and market movements.

For example, AI-powered fraud detection systems can scan for unusual behavior in transactions, such as inconsistencies in spending patterns or the use of new devices. These systems can then flag potential fraud and take immediate action, reducing the risk of financial losses and improving overall security. By automating the detection process, financial institutions can provide faster responses and greater protection for their clients.

AI in Customer Service and Personalization

AI is also significantly enhancing customer service in the fintech sector. With the rise of chatbots and virtual assistants, customers now have the ability to receive immediate responses to their inquiries, whether they are related to account balances, transaction histories, or financial advice. These AI-driven tools are available 24/7, offering an unprecedented level of convenience for customers while reducing operational costs for financial institutions.

Moreover, AI enables greater personalization in financial services. By analyzing customers’ spending habits, income levels, and investment preferences, AI can offer tailored financial products and services that align with individual needs. This level of customization enhances customer satisfaction and loyalty, as users receive more relevant advice, promotional offers, and investment opportunities.

Optimizing Investment Strategies

AI is revolutionizing the way investors make decisions. In the past, financial experts relied heavily on traditional analysis methods, including historical data and market trends, to predict investment outcomes. Today, AI can process vast amounts of data in real-time, including unstructured data such as news articles, social media sentiment, and global economic indicators, to make more informed investment decisions. Machine learning algorithms can detect emerging trends, forecast market fluctuations, and provide investment strategies that are more adaptive to the ever-changing financial environment.

Robo-advisors, powered by AI, are becoming increasingly popular in wealth management. These automated platforms use AI to offer personalized investment advice, balancing portfolios and suggesting strategies based on the individual investor's goals, risk tolerance, and financial status. Robo-advisors democratize access to professional-grade financial advice, making wealth management more accessible to a broader audience.

Revolutionizing Trading and Market Analysis

In the realm of trading, AI algorithms are making a significant impact by enhancing market analysis and optimizing trading strategies. AI can monitor market data in real-time, identify profitable patterns, and make high-speed, data-driven trading decisions. This capability allows financial institutions and individual traders to execute trades more efficiently, even on a global scale.

High-frequency trading (HFT) platforms powered by AI can analyze thousands of transactions per second, making it possible to spot short-term trends and capitalize on price movements that might otherwise be missed. Furthermore, AI can help reduce the emotional biases that often influence human traders, resulting in more rational and data-backed decision-making.

The Future of AI in Fintech

The future of AI in fintech looks promising, with continuous advancements in machine learning, natural language processing, and data analytics. As AI systems become more sophisticated, they will likely play an even larger role in shaping the financial services industry. Financial institutions will continue to invest in AI-driven technologies to streamline operations, improve security, and deliver more personalized services.

While AI’s integration into the fintech sector offers immense potential, it also presents challenges related to data privacy, regulatory compliance, and ethical considerations. However, as technology evolves and regulations adapt, AI in fintech will continue to drive innovation and efficiency in financial services.

Conclusion

AI is transforming the fintech industry by enhancing security, optimizing investments, and personalizing financial services. The ability of AI to process and analyze large volumes of data, identify patterns, and automate tasks is reshaping how financial institutions operate and deliver services to customers. With continued advancements and growing adoption, AI will remain at the forefront of fintech innovation, offering more opportunities for financial institutions and consumers alike.

Contact Us:

Akash Anand – Head of Business Development & Strategy

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

5G Fixed Wireless Access (FWA) Market Size