Indonesia Life & Non-Life Insurance Market Overview

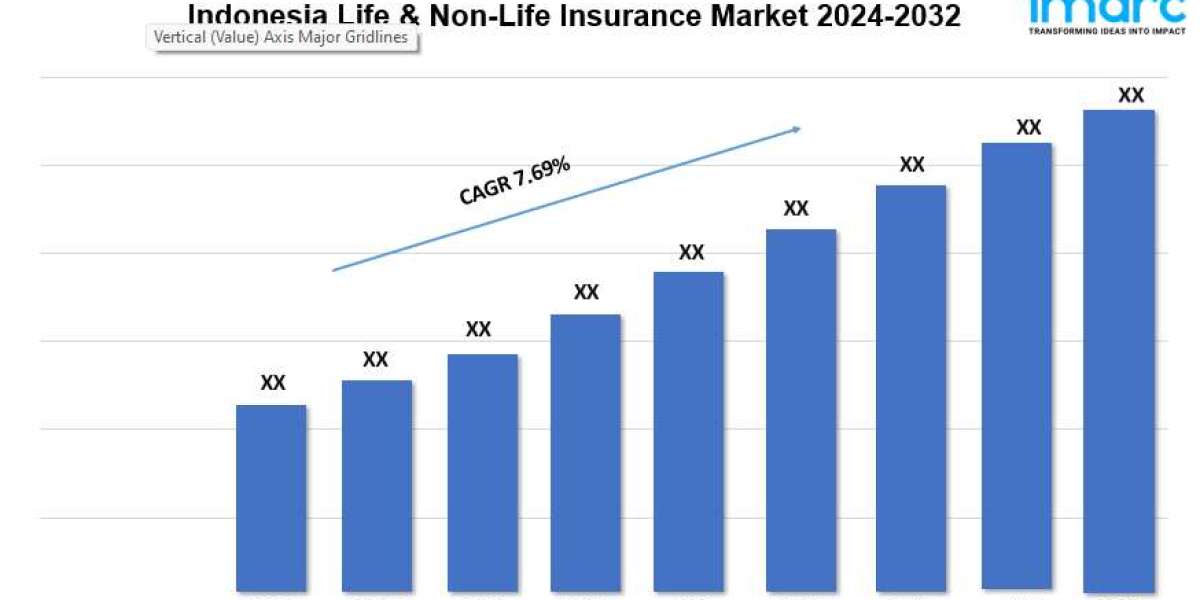

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 7.69% (2024-2032)

The growth of the Indonesia Life & Non-Life Insurance Market is driven by increasing financial literacy, rising middle-class income, and government initiatives to expand insurance coverage. According to the latest report by IMARC Group, Indonesia life & non-life Insurance market size is projected to exhibit a growth rate (CAGR) of 7.69% during 2024-2032.

Indonesia Life & Non-Life Insurance Market Trends and Drivers:

The Indonesia life & non-life insurance market is expanding rapidly, owing to the increasing awareness of financial protection among individuals and enterprises. Besides this, the need for different insurance products, including health, auto, and property insurance, is rising as the population increases and becomes more urbanized. In line with these factors, the efforts of the government bodies to improve insurance penetration, particularly through regulatory reforms and financial inclusion initiatives, are supporting the expansion of the Indonesia life & non-life insurance market. Moreover, life insurance is seeing growth due to rising income levels, greater awareness of long-term savings, and the need for retirement planning. In addition to these factors, the non-life segment benefits from increased demand for motor insurance and expanding infrastructure projects, which drive the need for property and casualty coverage.

Key trends shaping the Indonesia life & non-life insurance market include digital transformation and product innovation. Meanwhile, insurers are increasingly adopting digital platforms to offer more accessible, user-friendly services, allowing for easier claims processing and personalized policies. In line with these factors, the rise of insurtech is enhancing customer experience through mobile apps, online platforms, and artificial intelligence (AI). Consequently, microinsurance products are becoming popular, catering to low-income segments with affordable premiums and simplified policies. Apart from this, the growing importance of environmental, social, and governance (ESG) factors is influencing insurers to offer more sustainable products and services. These trends, combined with the overall economic expansion, are expected to fuel the Indonesia life & non-life insurance market in the coming years.

Download sample copy of the Report: https://www.imarcgroup.com/indonesia-life-non-life-insurance-market/requestsample

Indonesia Life & Non-Life Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Insurance Type Insights:

- Life Insurance

- Individual

- Group

- Non - Life Insurance

- Home

- Motor

- Health

- Rest of Non-Life Insurance

Distribution Channel Insights:

- Direct

- Agency

- Banks

- Online

- Others

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Great Eastern Holdings Limited (OCBC Bank)

- PT Asuransi Tokio Marine Indonesia (Tokio Marine Holdings Inc.)

- PT Bank Negara Indonesia (Persero) Tbk

- PT. Asuransi Jasa Indonesia

- PT. Asuransi Reliance Indonesia

- PT. Fistlight Indonesia

- PT. KB Insurance Indonesia

- The Chubb Corporation

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145