Digital Payments 2024

Digital payments have emerged as a cornerstone of modern commerce, revolutionizing the way businesses and consumers exchange money. From mobile wallets to online banking and cryptocurrency, the digital payments ecosystem has significantly evolved, providing faster, safer, and more convenient options for transactions. This transformation has not only enhanced user experiences but has also created immense opportunities for businesses to streamline their payment processes and expand into global markets. The Digital Payments Market Growth is being fueled by the rapid adoption of smartphones, the increasing popularity of e-commerce, and the growing demand for contactless payment solutions in the wake of the global pandemic.

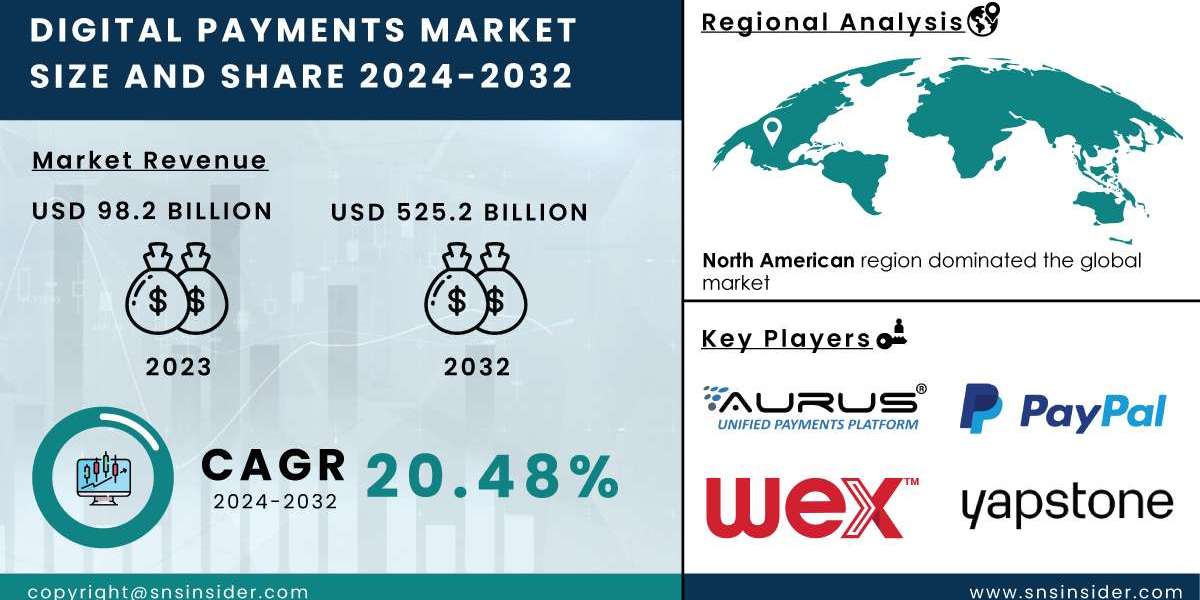

In today’s digital-first world, cash and checks are rapidly being replaced by digital alternatives, driven by technological advancements and changing consumer preferences. Digital payments allow for seamless transactions, whether it be a peer-to-peer transfer, an in-store purchase, or an international money transfer. This shift towards digitalization is further supported by government policies in various regions promoting cashless economies. Additionally, digital payments offer enhanced security through features like encryption and tokenization, making them more resilient against fraud and cyber threats compared to traditional payment methods. Digital Payments Market was valued at USD 98.2 Bn in 2023 and is expected to reach USD 525.2 Bn by 2032, growing at a CAGR of 20.48% over the forecast period 2024-2032.

Key Drivers of Growth in the Digital Payments Market

Several factors are driving the expansion of the digital payments market globally. One of the primary drivers is the increasing penetration of smartphones and internet connectivity, which has brought digital financial services to a broader demographic. Mobile wallets and payment apps have gained immense popularity, offering users an easy and convenient way to manage their finances. These platforms not only facilitate peer-to-peer payments but also support bill payments, e-commerce transactions, and contactless in-store purchases. As the global internet user base continues to expand, the demand for digital payment solutions is expected to rise significantly.

Another critical factor propelling market growth is the rise of e-commerce. As more consumers shop online, digital payments have become the default method for completing transactions. With e-commerce platforms offering integrated digital payment options, customers can make quick and secure purchases without the need for cash or physical credit cards. Moreover, the increasing adoption of Buy Now, Pay Later (BNPL) services has also contributed to the growth of the digital payments market, providing consumers with flexible payment options and boosting overall transaction volumes.

The Role of Fintech Innovations in Shaping the Market

The fintech industry has played a pivotal role in advancing the digital payments landscape. Startups and established players alike have introduced innovative solutions, from mobile payment platforms to blockchain-based payment networks. Fintech innovations are not only making payments faster and more efficient but are also improving access to financial services in underbanked regions. Technologies such as artificial intelligence and machine learning are being integrated into digital payment platforms to enhance fraud detection, improve personalization, and deliver better customer experiences.

Cryptocurrency is another area of interest within the digital payments market. While still in its early stages, cryptocurrencies like Bitcoin and Ethereum are gradually gaining traction as alternative payment methods. Some businesses and online platforms are beginning to accept cryptocurrencies for purchases, driven by their decentralized nature and potential for borderless transactions. Although the volatility of cryptocurrencies remains a challenge, their growing adoption could play a crucial role in shaping the future of digital payments.

Challenges and Opportunities

Despite the rapid growth of digital payments, the market faces several challenges. Security concerns and the risk of cyberattacks are significant hurdles, particularly as digital payment systems become more complex and interconnected. Maintaining the integrity of these systems and ensuring consumer data protection is paramount for the continued success of the market. Regulatory hurdles, particularly in developing countries, also pose challenges, as varying levels of digital infrastructure and government policies can affect the adoption rate of digital payments.

Nevertheless, the opportunities in the digital payments market are vast. As businesses and consumers continue to embrace digital solutions, the demand for new and improved payment technologies will only increase. Companies that can innovate and offer seamless, secure, and scalable payment solutions will be well-positioned to capitalize on the market's growth.

Conclusion

The future of payments is undoubtedly digital. With the rise of mobile wallets, contactless payments, and cryptocurrencies, the way people and businesses exchange money is undergoing a rapid transformation. As digital payments continue to evolve, they will play an increasingly critical role in driving global commerce and financial inclusion. The Digital Payments Market is set to experience tremendous growth in the coming years, propelled by technological advancements, changing consumer behaviors, and the ongoing shift toward cashless societies. Businesses and fintech companies that can adapt to these changes and offer innovative solutions will find themselves at the forefront of this dynamic and lucrative market.

Contact Us:

Akash Anand – Head of Business Development & Strategy

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports: