Forensic Accounting Services 2024

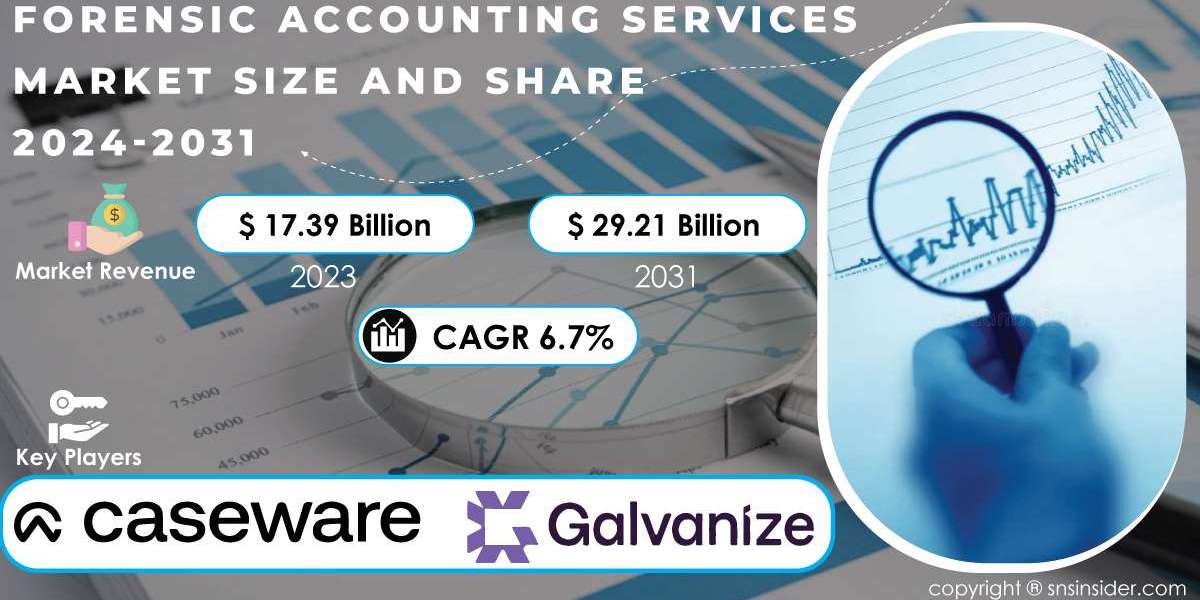

Forensic accounting services have emerged as a crucial element in the intersection of finance, law, and investigative practices. These specialized services involve the application of accounting principles and techniques to investigate financial discrepancies, fraud, and other financial crimes. As businesses increasingly face complex financial challenges and regulatory scrutiny, the demand for forensic accounting services has surged, reflecting the importance of these professionals in both legal and corporate settings. The Forensic Accounting Services Market Share highlights this growth, with the market size valued at USD 17.39 billion in 2023 and expected to reach USD 31.17 billion by 2032, growing at a CAGR of 6.7% over the forecast period from 2024 to 2032.

The Role of Forensic Accountants

Forensic accountants play a pivotal role in uncovering financial wrongdoing and ensuring transparency in financial reporting. Their work often begins with the identification of potential fraud or irregularities, which may arise from tips, whistleblowers, or routine audits. Once a concern is raised, forensic accountants conduct thorough investigations that include analyzing financial records, reviewing transactions, and interviewing relevant parties.

One of the key responsibilities of forensic accountants is to assess the financial condition of an organization. This involves examining financial statements, tax returns, and other documents to identify any inconsistencies or fraudulent activities. They employ advanced analytical techniques to detect patterns that may indicate fraudulent behavior, such as unusual transactions, discrepancies in accounting records, or deviations from standard business practices.

In many cases, forensic accountants are called upon to testify in legal proceedings as expert witnesses. Their ability to present complex financial information in a clear and understandable manner is critical in court, where their findings can influence the outcomes of legal disputes and investigations.

Applications of Forensic Accounting

Forensic accounting services are utilized across various industries and for different purposes. One of the most common applications is in fraud detection and prevention. Organizations often engage forensic accountants to conduct audits that focus specifically on identifying fraudulent activities, such as embezzlement, money laundering, or financial statement fraud. By identifying vulnerabilities in financial controls, these professionals help organizations strengthen their defenses against future fraud.

Another significant area where forensic accountants provide value is in litigation support. In disputes related to contracts, mergers and acquisitions, or shareholder disagreements, forensic accountants can analyze financial data to determine the economic impact of the issues at hand. Their findings can help legal teams build stronger cases, negotiate settlements, or support claims for damages.

Additionally, forensic accountants are instrumental in resolving financial disputes in divorce proceedings, where the accurate valuation of assets is essential. They assess the financial situation of both parties, uncover hidden assets, and ensure a fair distribution of wealth.

The Process of Forensic Investigation

The forensic accounting process typically involves several key stages. Initially, forensic accountants define the scope of the investigation. This may involve understanding the background of the case, identifying the parties involved, and determining the specific financial issues to be addressed.

Once the scope is defined, forensic accountants begin the data collection phase. This involves gathering relevant documents, such as bank statements, invoices, contracts, and other financial records. The analysis phase follows, where the collected data is scrutinized for anomalies, patterns, and inconsistencies. Forensic accountants utilize various analytical tools and techniques, including data mining and statistical analysis, to uncover hidden trends and identify potential fraudulent activities.

After the analysis is complete, forensic accountants compile their findings into a comprehensive report. This report not only outlines the investigative process but also presents the evidence gathered and the conclusions drawn from the analysis. In cases that proceed to litigation, the forensic accountant may be required to testify in court, explaining their findings and providing expert opinions.

Challenges in Forensic Accounting

While forensic accounting is a critical service, it is not without its challenges. One of the primary difficulties faced by forensic accountants is the increasing sophistication of financial fraud. As technology advances, so do the methods employed by fraudsters, making it essential for forensic accountants to stay informed about emerging trends and techniques.

Moreover, the vast amount of data generated by organizations can complicate investigations. Forensic accountants must navigate through large volumes of financial records, which can be time-consuming and resource-intensive. To address this challenge, many forensic accountants leverage advanced software tools that can automate data analysis, enabling them to focus on higher-level investigative tasks.

Another challenge is the need for collaboration with legal professionals. Forensic accountants must work closely with attorneys to ensure that their findings are presented effectively in court. This collaboration requires strong communication skills and a clear understanding of legal principles, as forensic accountants must convey complex financial concepts to non-financial audiences.

The Future of Forensic Accounting

The future of forensic accounting is poised for significant growth and transformation. As businesses face increasing regulatory pressures and the complexity of financial transactions continues to rise, the demand for skilled forensic accountants will likely increase. Organizations will seek out these professionals not only for fraud detection but also for proactive measures to enhance their financial controls and compliance efforts.

Technological advancements will also shape the future of forensic accounting. The integration of artificial intelligence and machine learning into forensic investigations can streamline data analysis and improve the accuracy of fraud detection. These technologies can help forensic accountants identify potential risks more quickly and efficiently, allowing organizations to respond proactively to threats.

Additionally, the globalization of business operations will require forensic accountants to develop a deeper understanding of international regulations and compliance requirements. As organizations expand their operations across borders, the complexities of cross-border transactions and the potential for fraud will necessitate specialized knowledge and expertise.

Conclusion

Forensic accounting services play a vital role in maintaining the integrity of financial systems and ensuring accountability in business practices. As organizations face increasingly complex financial landscapes and rising risks of fraud, the importance of skilled forensic accountants cannot be overstated. The Forensic Accounting Services Market reflects this growing demand, highlighting the critical role these professionals play in protecting organizations from financial misconduct. As we look to the future, advancements in technology and the evolving regulatory environment will further enhance the significance of forensic accounting, making it an indispensable part of modern finance and business operations.

Contact Us:

Akash Anand – Head of Business Development & Strategy

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Cloud Advertising Market Report