Understanding Shariah-Compliant Finance

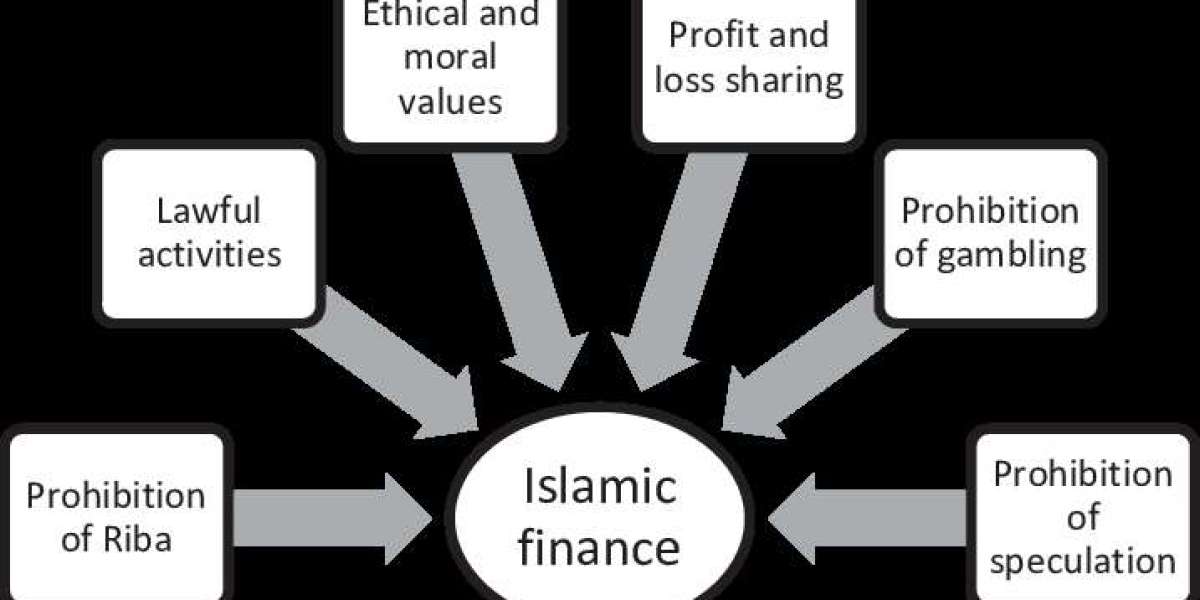

Shariah-compliant finance refers to financial practices that adhere to Islamic law, or Shariah, which prohibits activities involving interest (riba), excessive uncertainty (gharar), and gambling (maysir). For those asking, "What is gharar in Islam?" it refers to excessive uncertainty in contractual terms and conditions, which is forbidden in Islamic finance. The core principles of Islamic finance emphasize equity, fairness, and transparency, ensuring all financial activities contribute to the welfare of society. This unique approach has led to the development of innovative financial products that align with ethical and religious standards, thereby offering alternative solutions to conventional finance.

The Significance of Shariah-Compliant Financial Products

Shariah-compliant financial products have gained significant traction in the global market due to their ethical foundation and inclusivity. These products not only cater to the financial needs of Muslim consumers but also appeal to those seeking ethical investment opportunities. The proliferation of these products has demonstrated that finance can operate successfully within the parameters of religious beliefs without compromising on efficiency or profitability.

Different Types of Shariah-Compliant Financial Products

Sukuk: The Islamic Equivalent of Bonds

Sukuk represents an innovative Shariah-compliant financial product that has gained popularity in global markets. Unlike conventional bonds, sukuk do not pay interest. Instead, they generate returns through profit-sharing or leasing arrangements. This structure ensures compliance with Islamic law while providing investors with stable returns. Corporations and governments in both Muslim-majority and non-Muslim countries have issued sukuk, highlighting their versatility and appeal.

Islamic Mortgages: A Path to Home Ownership

Islamic mortgages, also known as home purchase plans, are designed to comply with Shariah by avoiding interest. One common structure, known as diminishing musharakah, involves the bank and the customer jointly purchasing the property. Over time, the customer buys out the bank's share, eventually becoming the sole owner. This product allows Muslims to achieve home ownership without violating their religious principles.

The Role of Ijarah in Islamic Finance

The concept of ijarah, or leasing, plays a critical role in many Shariah-compliant financial products. In an ijarah agreement, the lessor retains ownership of the asset while transferring its usufruct to the lessee for an agreed period and a specified rent. This ensures that financial transactions remain free from interest and speculative practices. The ijarah system is particularly prevalent in sectors such as property, equipment leasing, and vehicle financing, providing flexible and ethical financial solutions.

The Global Impact of Shariah-Compliant Financial Products

Expanding Market Reach

The growing acceptance and demand for Shariah-compliant financial products have led to their expansion across global markets. These products have found favor not only in Muslim-majority regions such as the Middle East and Southeast Asia but also in Western countries with significant Muslim populations. This expansion has facilitated greater financial inclusion and contributed to the global financial ecosystem's diversity.

Driving Economic Development

Shariah-compliant financial products contribute to economic development by promoting responsible and ethical investment practices. By avoiding activities deemed harmful or speculative, these products encourage long-term, sustainable growth. Investments are directed towards projects that have real economic value, such as infrastructure, healthcare, and education. This approach aligns with the goals of Islamic finance to support social welfare and development.

Challenges and Opportunities

Addressing Regulatory Discrepancies

One of the key challenges facing Shariah-compliant financial products is the variation in regulations across different jurisdictions. This can create complexities for institutions operating in multiple markets. Harmonizing regulatory standards and fostering international cooperation are essential steps towards overcoming these challenges and achieving greater consistency in the application of Shariah principles.

Enhancing Public Awareness and Education

Improving awareness and understanding of Shariah-compliant financial products is crucial for their continued growth. Efforts to educate consumers, investors, and financial professionals about the principles and benefits of Islamic finance can drive adoption and acceptance. Programs such as the Islamic finance PhD offer deep insights into the theoretical and practical aspects of this field, equipping scholars and practitioners with the knowledge to navigate and innovate within this sector.

Innovative Shariah-Compliant Financial Products in Action

Takaful: Islamic Insurance

Takaful, a form of Islamic insurance, operates on the principles of mutual assistance and shared responsibility. Participants contribute to a common pool, which is used to compensate those who suffer losses. Any surplus is distributed among the participants or reinvested. This cooperative model aligns with the ethical values of Islamic finance and provides a viable alternative to conventional insurance.

Islamic Crowdfunding: Financial Inclusivity

Islamic crowdfunding platforms have emerged as innovative tools for financing entrepreneurial ventures and community projects. These platforms adhere to Shariah principles by avoiding interest-based transactions and ensuring that funded projects comply with Islamic values. This approach democratizes access to finance, allowing individuals and small businesses to raise capital while adhering to their ethical standards.

The Future of Shariah-Compliant Financial Products

Leveraging Technology

The integration of technology in Shariah-compliant finance is driving innovation and access. Fintech solutions, such as blockchain and artificial intelligence, are being leveraged to enhance transparency, efficiency, and security in financial transactions. These advancements are poised to revolutionize the delivery and management of Islamic financial products, making them more accessible and appealing to a broader audience.

Expanding Product Offerings

As the demand for Shariah-compliant financial products grows, institutions are continuously developing new offerings to meet diverse needs. From ethical investment funds to Shariah-compliant pensions, the range of products is expanding to cater to various financial objectives and life stages. This ongoing innovation ensures that Islamic finance remains relevant and competitive in the global market.

Conclusion: A Bright Future for Shariah-Compliant Finance

The rise of Shariah-compliant financial products underscores the potential for finance that respects ethical and religious principles while contributing to global economic development. As awareness increases and innovations continue to emerge, these products are set to play a pivotal role in shaping the future of the financial industry. Whether through the expansion of sukuk, the adoption of Islamic mortgages, or the growth of Takaful insurance, Shariah-compliant finance offers viable and inclusive alternatives that align with the values of millions around the world. With ongoing education, like that provided by programs such as the Islamic finance PhD, and continuous collaboration among financial institutions, Shariah-compliant financial products are well-positioned to make significant strides in both the financial and ethical realms, offering a harmonious blend of faith and economic prosperity.

Read another article ''Real Estate Market 2024: Industry Insight, Drivers, Trends, Global Analysis and Forecast by 2032''