Plasma Fractionation Market: A Look at Global Leaders and Regional Trends (April 2024)

The plasma fractionation market plays a vital role in healthcare, transforming donated blood plasma into life-saving therapies. These treatments address a wide range of conditions, including immune deficiencies, chronic diseases, and blood clotting disorders. As the global demand for plasma-derived medications continues to rise, let's delve into the current market landscape, with a specific focus on the United States, Russia, South Korea, and the United Kingdom.

Market Growth and Drivers

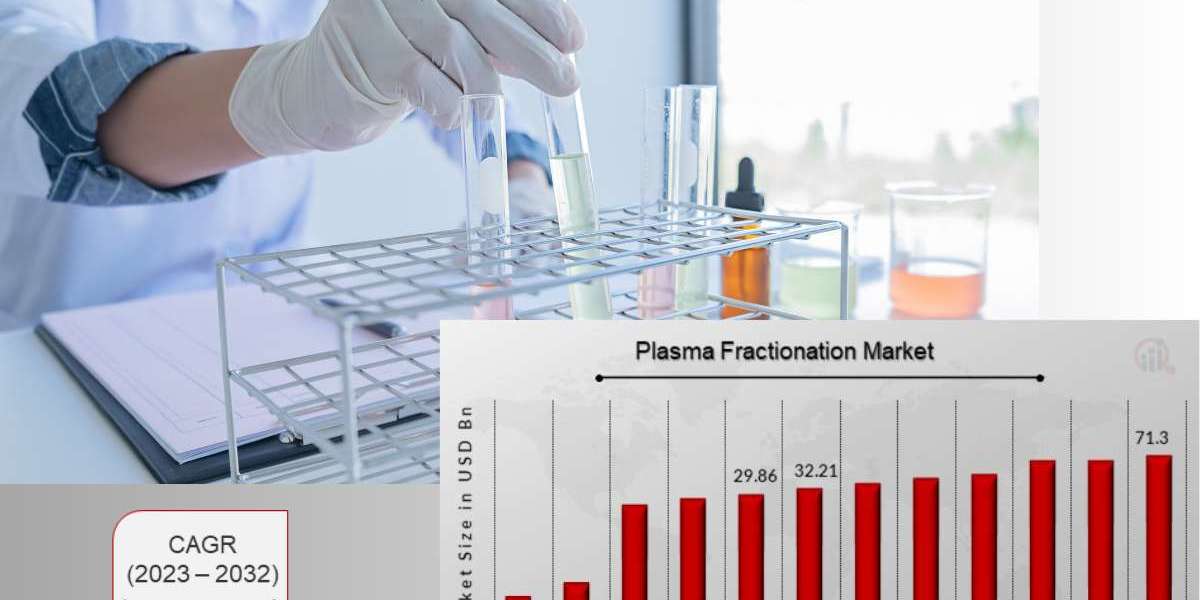

The global plasma fractionation market is expected to reach a staggering USD 53.01 billion by 2032, driven by several key factors:

- Aging Population: The increasing elderly population worldwide is a significant driver, as they are more susceptible to chronic conditions treatable with plasma-derived therapies.

- Rising Disease Burden: The prevalence of chronic diseases like hemophilia, autoimmune disorders, and neurological conditions is on the rise, fueling the demand for plasma-based treatments.

- Technological Advancements: Advancements in fractionation techniques are enabling the development of more targeted and efficacious therapies, further propelling market growth.

Regional Landscape

1. United States Plasma Fractionation Market

The United States plasma fractionation market dominates the global sector, accounting for a significant share due to factors like:

- Large Donor Base: The US has a well-established plasma collection infrastructure, facilitating a readily available supply of plasma.

- High Healthcare Expenditure: The US healthcare system is characterized by high spending, allowing for greater adoption of plasma-derived therapies.

- Strong Regulatory Framework: A robust regulatory environment ensures the safety and efficacy of plasma-derived products.

Recent Industry News in the US:

- CSL Limited (Australia): In February 2024, CSL announced a $725 million expansion of its plasma collection facilities in the US, aiming to meet the growing demand for plasma-derived therapies.

- Takeda Pharmaceutical Company (Japan): Takeda is actively involved in research and development of next-generation plasma-derived therapies, focusing on areas like gene therapy and personalized medicine.

- Grifols S.A. (Spain): Grifols continues to invest in plasma collection centers across the US and is exploring strategic partnerships to enhance its plasma collection capabilities.

2. Russia Plasma Fractionation Market

The Russian plasma fractionation market is undergoing an exciting growth phase, driven by:

- Government Initiatives: The Russian government is implementing policies to promote domestic production of plasma-derived therapies, reducing dependence on imports.

- Modernization Efforts: Existing plasma fractionation facilities are being modernized to meet international quality standards.

- Increasing Awareness: Growing awareness about the benefits of plasma-derived therapies is stimulating market demand.

3. South Korea Plasma Fractionation Market

South Korea boasts a rapidly growing plasma fractionation market, fueled by:

- Technological Innovation: South Korean companies are investing heavily in research and development of novel plasma fractionation technologies.

- Government Support: The South Korean government is actively supporting the development of the domestic plasma fractionation industry.

- Focus on Self-sufficiency: South Korea aims to achieve self-sufficiency in plasma-derived therapies, reducing reliance on foreign imports.

4. United Kingdom Plasma Fractionation Market

The United Kingdom plasma fractionation market is mature and well-established, characterized by:

- Stringent Regulations: The UK has stringent regulations for plasma collection and fractionation, ensuring patient safety.

- Public Healthcare System: The National Health Service (NHS) plays a crucial role in driving the demand for plasma-derived therapies.

- Focus on Sustainability: UK-based companies are focusing on sustainable plasma collection practices to ensure a reliable supply of plasma.

Recent Industry News in Europe (including UK):

- Octapharma AG (Switzerland): Octapharma recently announced a €300 million investment to expand its plasma fractionation capacity in Europe, including the UK.

- Bio Products Laboratory Ltd (UK): BPL is actively involved in collaborative research with academic institutions to develop new and improved plasma-derived therapies.

- Kedrion S.p.A. (Italy): Kedrion is expanding its footprint in the UK plasma collection market through strategic acquisitions and partnerships.

Top Players in the Plasma Fractionation Market

Several companies are at the forefront of the global plasma fractionation market, including:

· CSL (Australia)

· Grifols S.A. (Spain)

· Takeda Pharmaceutical Company Limited (Japan)

· Octapharma AG (Switzerland)

· Pfizer, Inc (US)

· Bio Products Laboratory Ltd (UK)

· Kedrion S.p.A (Italy)

· ADMA Biologics, Inc (US)

· Japan Blood Products Organization (Japan)

· KM Biologics (Japan)

For more information visit at MarketResearchFuture

Other Trending Reports