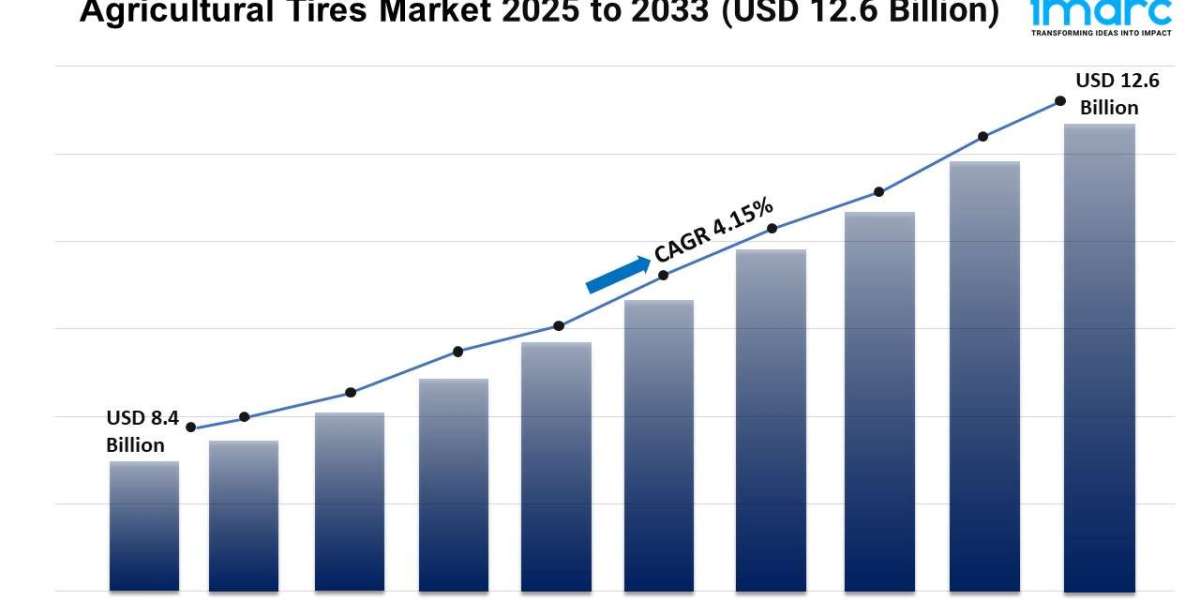

Global Agricultural Tires Market Statistics: USD12.6Billion Value by 2033

Agricultural Tires Industry

Summary:

- The global agricultural tires market size reached USD8.4Billion in 2024.

- The market is expected to reach USD12.6Billion by 2033, exhibiting a growth rate (CAGR) of4.15% during 2025-2033.

- North America leads the market, accounting for the largest agricultural tires market share.

- Bias tires account for the majority of the market share in the product segment due to their durability, affordability, and ability to perform well on uneven, rugged agricultural terrains.

- Tractors represent the leading application segment.

- Aftermarket holds the largest share in the agricultural tires

- The increasing mechanization of agricultural activities is a primary driver of the agricultural tires

- Technological innovations in tire design and manufacturing processes are reshaping the agricultural tires

Request for a sample copy of this report: https://www.imarcgroup.com/agricultural-tires-market/requestsample

Industry Trends and Drivers:

- Growing Mechanization of Farming Practices:

The increasing mechanization of agricultural activities is impelling the growth of the market. As farmers shift toward the use of advanced machinery to enhance productivity and minimize labor costs, the demand for agricultural tires has surged. Tractors, harvesters, and other farm equipment rely heavily on specialized tires capable of withstanding harsh terrains, from muddy fields to rocky surfaces. In emerging economies, this trend is gaining traction as governments encourage modernized farming practices to boost food production. Larger farms, in particular, require powerful machines, driving the demand for durable tires that provide stability, load-bearing capacity, and reduced soil compaction. As a result, the use of agricultural tires is rising in response to the adoption of efficient mechanized farming solutions, with tire manufacturers focusing on providing products that enhance vehicle performance and longevity under varying agricultural conditions.

- Increase in Global Food Demand:

Rising global food demand, driven by population growth, is positively influencing the agricultural sector. As the pressure to increase crop production intensifies, farmers are adopting larger, more powerful machinery, which necessitates the use of advanced agricultural tires designed to handle heavy loads and varied terrains. These tires are essential for improving the efficiency and productivity of farming operations, allowing farmers to meet the growing food supply needs. In addition, expanding agricultural activities in various regions, where agricultural mechanization is still developing, is further catalyzing the demand for agricultural tires. This is particularly pronounced as governments and organizations invest in sustainable farming practices to address food security concerns. As a result, the need for high-performance tires capable of supporting more extensive farming operations is rising.

- Technological Advancements in Tire Manufacturing:

Technological innovations in tire design and manufacturing processes are playing a crucial role in bolstering the market growth. New developments, such as radial tires, which offer improved traction and better load distribution, are gaining traction among farmers. These advanced tires reduce soil compaction, which is vital for maintaining soil health and crop yields. Self-cleaning treads, puncture-resistant materials, and eco-friendly components are further enhancing the durability and performance of agricultural tires. Additionally, manufacturers are incorporating smart tire technologies, such as sensors that monitor tire pressure and wear, allowing farmers to optimize machinery performance and reduce downtime. These innovations make agricultural operations more efficient, while the reduced wear and tear on the tires lower replacement costs.

Our report provides a deep dive into the agricultural tiresmarket analysis, outlining the current trends, underlying market demand, and growth trajectories.

Agricultural Tires Market Report Segmentation:

Breakup By Product:

- Bias Tires

- Radial Tires

Bias tires hold the biggest market share due to their superior flexibility and ability to provide better traction on uneven terrains, making them ideal for various farming applications.

Breakup By Application:

- Tractors

- Harvester

- Forestry

- Irrigation

- Trailers

- Others

Tractors account for the majority of the market share owing to the high demand for specialized tires that enhance their performance and efficiency in fieldwork.

Breakup By Distribution:

- OEM

- Aftermarket

Aftermarket represents the largest segment driven by the need for replacement tires as agricultural equipment undergoes wear and tear from regular use in demanding environments.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America's dominance in the agricultural tires market is attributed to its advanced agricultural practices, high levels of mechanization, and strong demand for specialized equipment to meet the needs of diverse farming operations.

Top Agricultural Tires Market Leaders:

The agricultural tires market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Apollo Tyres Limited

- Balkrishna Industries Limited (BKT)

- Bridgestone Corporation

- CEAT Ltd. (RPG Group)

- Continental AG

- JK Tyre Industries Ltd.

- MRF Limited

- Specialty Tires of America Inc.

- Sumitomo Rubber Industries Ltd.

- TBC Corporation (Michelin)

- The Carlstar Group LLC

- Titan International Inc.

- Trelleborg AB

- Yokohama Off-Highway Tires America Inc. (Yokohama Rubber Company)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163