Green Hydrogen Market Outlook 2024-2033

Green Hydrogen Market Growth is expected to grow at a compound annual growth rate (CAGR) of 39.3% between 2024 and 2033. Based on an average growth pattern, it is estimated to reach USD 135.2 billion at that time. It is projected that in 2024, the market will be worth USD 7.82 billion.

What is Green Hydrogen?

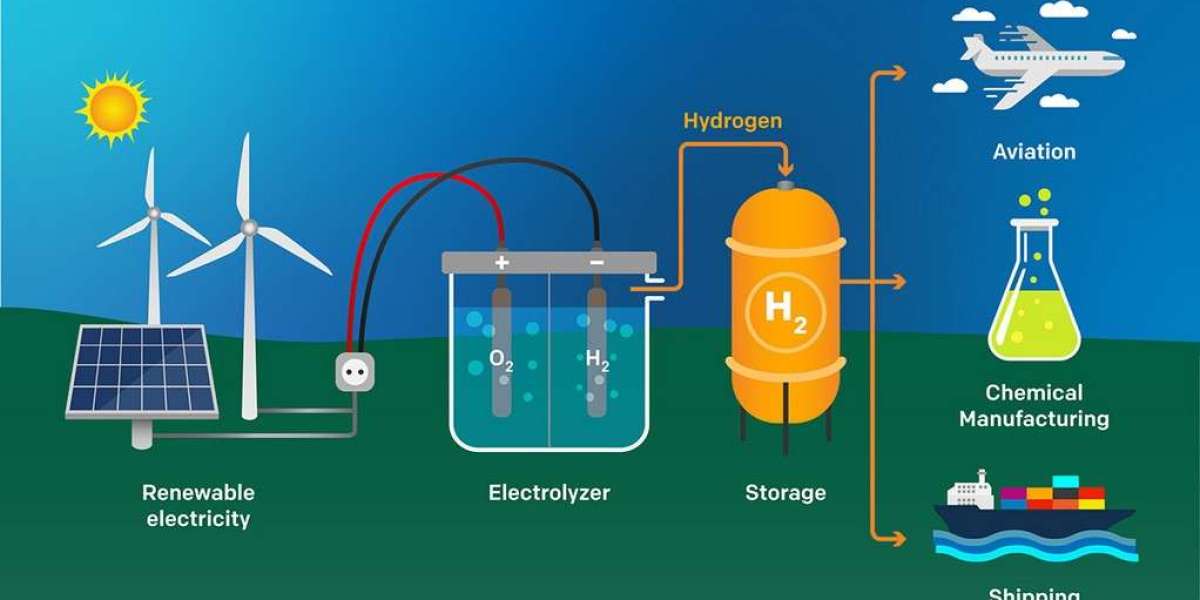

Green hydrogen is hydrogen produced by electrolysis, using electricity generated from renewable sources like wind, solar, or hydropower. This makes it a zero-emission energy carrier, in contrast to gray hydrogen, which is produced using fossil fuels, and blue hydrogen, where carbon emissions are captured and stored. Green hydrogen’s environmental benefits are immense, as it can be produced without emitting carbon dioxide, making it one of the cleanest energy sources available.

Get free access to sample report @ https://wemarketresearch.com/reports/request-free-sample-pdf/green-hydrogen-market/1341

Green Hydrogen Market Dynamics:

Governmental Rewards Encourage Green Hydrogen Projects

The industry is growing because of government subsidies, which are essential in supporting green hydrogen activities. For example, the National Hydrogen Strategy of Germany provides funding for hydrogen-related projects. In a similar vein, tax credits are offered by the US for the generation of hydrogen and financing infrastructural projects. These subsidies not only lower businesses' financial hurdles but also demonstrate the government's commitment to transforming the hydrogen economy into a sustainable one, which propels market growth.

Technological Progress Boosts Electrolyser Performance

Technological advancements including enhanced catalysts, membrane materials, and system designs increase electrolysis processes while cutting expenses and energy usage. Green hydrogen production is becoming more and more competitive with traditional hydrogen production techniques because to its higher efficiency, which results in increased hydrogen output with less energy input. This increase in efficiency is not only brings down the total cost of producing hydrogen, but it also speeds up the market's acceptance of green hydrogen in a variety of industries.

The Growing Demand for Green Hydrogen

- Decarbonization Goals: Many countries have set ambitious targets to achieve net-zero carbon emissions by mid-century. Green hydrogen is seen as a crucial element in achieving these goals, particularly in hard-to-abate sectors like heavy industry, transportation, and power generation.

- Energy Storage: One of the biggest challenges with renewable energy sources like solar and wind is their intermittent nature. Green hydrogen offers a solution by acting as an energy storage medium. It can store excess renewable energy and be converted back into electricity or used as a fuel when needed, thus enhancing grid stability.

- Industrial Applications: Green hydrogen is not just limited to energy production; it has the potential to revolutionize industrial processes. It can be used as a feedstock in the production of ammonia for fertilizers, in refining processes, and in steelmaking, where it can replace carbon-intensive coke.

- Transportation: The transportation sector, responsible for a significant portion of global emissions, is another area where green hydrogen can make a substantial impact. Hydrogen fuel cells can power everything from cars to buses, trucks, trains, and even ships, offering a zero-emission alternative to traditional fossil fuels.

Enquire for customization in Report @ https://wemarketresearch.com/customization/green-hydrogen-market/1341

Key Applications of Green Hydrogen

- Transportation

Hydrogen-powered fuel cells can replace conventional fossil fuels in transportation, particularly in sectors where batteries are less practical, such as aviation, shipping, and heavy-duty trucks. Countries like Japan and South Korea are already investing heavily in hydrogen-powered vehicles and infrastructure.

- Energy Storage

Green hydrogen can store excess renewable energy generated during periods of high solar or wind activity. This stored hydrogen can then be converted back into electricity when demand rises, solving one of the key challenges of renewable energy: intermittency.

- Industrial Processes

Green hydrogen can be used as a feedstock in industries such as ammonia production and oil refining, which traditionally rely on carbon-intensive processes. It can also power energy-intensive industries, enabling a shift from coal or natural gas to a cleaner alternative.

Opportunities on the Horizon

Decentralized Energy Systems: Green hydrogen could power local microgrids, enabling remote communities to achieve energy independence from centralized fossil fuel power sources.

International Energy Trade: Countries rich in renewable resources could export green hydrogen to nations with less renewable capacity. For example, Australia and the Middle East are positioning themselves as major green hydrogen exporters.

Carbon Pricing: As more countries implement carbon pricing mechanisms, industries will be incentivized to shift toward green hydrogen to reduce emissions costs.

Carbon-Free Fuel for Industry and Transportation

Green hydrogen is a flexible energy source that provides a long-term way to reduce carbon emissions in industries that have historically relied on fossil fuels. Market expansion prospects are enormous due to its potential as a clean substitute for energy storage, industrial operations, and automotive fuel.

Challenges Facing the Green Hydrogen Market

High Production Costs: Producing green hydrogen remains more expensive than gray or blue hydrogen due to the high cost of electrolyzers and the large amounts of renewable electricity required.

Infrastructure: A widespread hydrogen economy will require significant investment in new infrastructure, including hydrogen pipelines, storage facilities, and refueling stations.

Efficiency Losses: The process of generating, storing, and converting green hydrogen back into usable energy involves energy losses. While green hydrogen is an excellent solution for hard-to-decarbonize sectors, these efficiency losses need to be minimized.

Policy Uncertainty: The success of the green hydrogen market heavily depends on government policies and incentives. Inconsistent or inadequate policy support could slow market growth.

Market Segments:

By Application

- Power Generation

- Transport

By Renewable Source

- Wind

- Solar

By End User

- Food & Beverages

- Medical

- Mobility

- Industrial

- Glass

- Grid Injection

- Petrochemicals

- Power

- Chemical

Market Regional Analysis:

Europe Market Prediction

With a market share of more than 47%, Europe leads the global green hydrogen industry in terms of revenue generation. Because of the substantial investments being made in this field by nations like Germany, France, and the Netherlands, Europe now has the greatest market for green hydrogen in the world.

Market Statistics for Asia-Pacific

The second-biggest market for green hydrogen is Asia Pacific. In the upcoming years, the green hydrogen sector is expected to grow at the quickest rate in the Asia Pacific area. As air pollution concerns grow, China, Japan, and South Korea are making investments in this field to lessen their reliance on imported fossil fuels

Forecasts for the North American Market

Over the course of the forecast period, North America is anticipated to grow at the quickest rate in the green hydrogen market. Although it is still in its infancy, the green hydrogen market in North America is anticipated to expand quickly in the years to come.

Top Leading Key Companies:

- Power Cell Sweden AB

- Green Hydrogen Systems

- Bayo Tech

- Ballard Power Systems

- Cummins Inc.

- Siemens Energy

- Nel ASA

- Plug Power Inc.

- Enapter S.r.l.

- Areva H2Gen

- HydrogenPro

- Linde plc

- ENGIE SA

- Kawasaki Heavy Industries, Ltd.

- Others

Conclusion

The green hydrogen market represents a vital and rapidly growing sector within the renewable energy landscape. While challenges like cost, infrastructure, and policy uncertainty remain, the opportunities it presents—especially in decarbonizing hard-to-abate sectors—are enormous. With the right investments and global cooperation, green hydrogen could be the key to achieving a sustainable, zero-carbon future.

Click Here for Purchase Report @ https://wemarketresearch.com/purchase/green-hydrogen-market/1341?license=single

About We Market Research:

WE MARKET RESEARCH is an established market analytics and research firm with a domain experience sprawling across different industries. We have been working on multi-county market studies right from our inception. Over the time, from our existence, we have gained laurels for our deep-rooted market studies and insightful analysis of different markets.